by Elizabeth Hines | Apr 6, 2015 | Big Data, Blog, Data/Analytics

Concurrent with the extraordinary rise of the Internet of Things (IoT), predictive analytics are gaining in popularity. With an increasing number of companies learning to master the precursors to developing predictive models — namely, connecting, monitoring, and analyzing — we can safely assume the art of gleaning business intelligence from foresight will continue to grow rapidly.

Indeed, Gartner analysts put forward that “few technology areas will have greater potential to improve the financial performance and position of a commercial global enterprise than predictive analytics.” And executives seem eager to jump on the bandwagon; in a survey of executives conducted by Accenture a full 88% indicated big data analytics is a top priority for their company. Amid the promises of predictive analytics, however, we also find a number of pitfalls. Some experts caution there are situations when predictive analytics techniques can prove inadequate, if not useless.

Here, we dissect three problems most commonly encountered by companies employing predictive analytics.

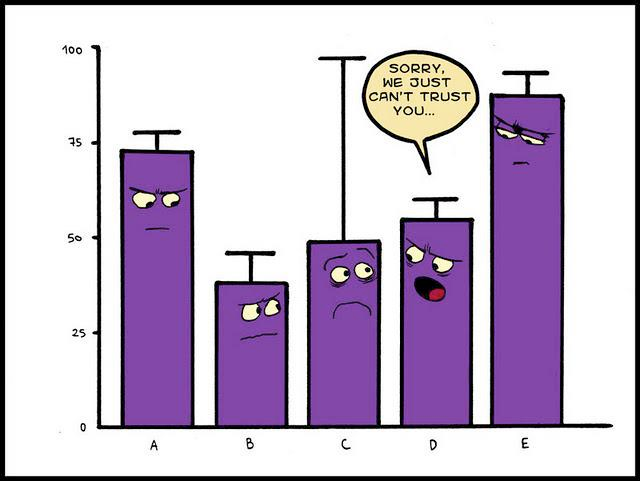

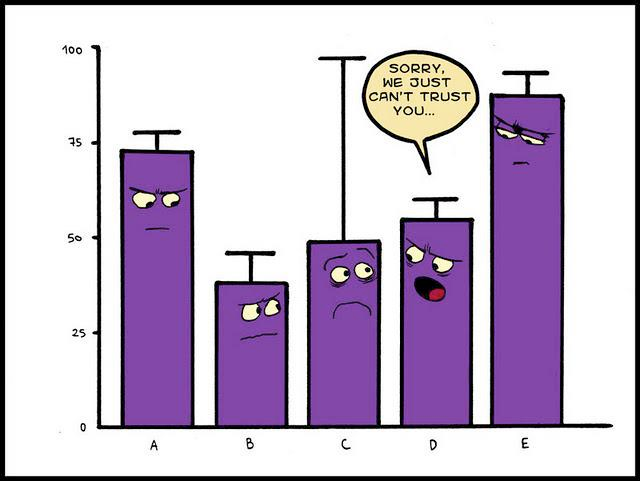

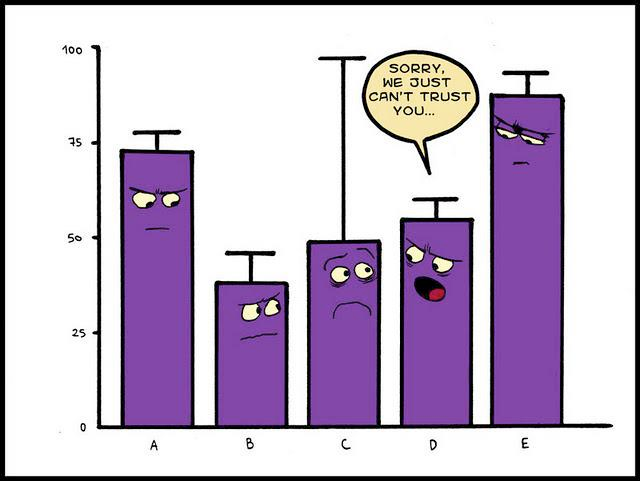

Past as a poor predictor of the future

The concept of predictive analytics is predicated on the assumption that future behavior can be more or less determined by examining past behaviors; that is, predictive analytics works well in a stable environment in which the future of the business is likely to resemble its past and present. But Harvard Business School professor Clayton Christensen points out that in the event of a major disruption, the past will do a poor job of foreshadowing future events. As an example, he cites the advent of PCs and commodity servers, arguing computer vendors who specialized in minicomputers in the 1980s couldn’t possibly have predicted their sales impact, since they were innovations and there was no data to analyze.

Interpreting bias

Consider also the bias in favor of a positive result when interpreting data for predictive purposes; it is one of the most common errors in predictive analytics projects. Speaking at the 2014 Predictive Analytics World conference in Boston, John Elder, president of consulting firm Elder Research, Inc., made a good point when he noted that people “‘often look for data to justify our decisions,’ when it should be the other way around.”

Collecting and analyzing unhelpful or superfluous data

Failure to tie data efforts to operational processes can lead to an unnecessary drain of staff resources. Mining big data will do little good if the insights are not directly tied to functional procedures. More companies than we probably realize are wasting precious time and manpower on big data projects that are not adequately understood, producing trivia rather than actionable business intelligence.

To overcome these common pitfalls of predictive analytics, spend some time reviewing the sources of your data and the basic assumptions on which your predictive analytics projects are based. Because the major principle of predictive analytics is that the past behavior can forecast future behavior, keep your ear to the ground for growing industry trends or any other factors that might influence consumer behavior. Plan to revisit the source of your data frequently to determine if the sample set is representative of your future set and should continue to be used. Most importantly, regularly evaluate how your predictive analysis relates and contributes to your company’s overall goals and objectives.

What else do you think organizations can do to ward off the snags of predictive data analysis and use foresight more effectively?

by Fronetics | Mar 19, 2015 | Big Data, Blog, Data/Analytics

“[Companies] don’t know how to manage it, analyze it in ways that enhance their understanding, and then make changes in response to new insights… they don’t magically develop those competencies just because they’ve invested in high-end analytics tools.” –You May Not Need Big Data After All” Harvard Business Review, December 2013

Since the concept of big data became the buzzword du jour, big data has become big business. But a recent study by Harvard Business School suggests that many big-data investments fail to deliver because most companies can’t handle the information they already have. That’s why when it comes to big data, bigger is not always better, particularly for small to midsized companies. Lured by the promise of big payoffs, many companies have sunk millions of dollars into sophisticated data analytics software only to realize they did not have the capabilities to interpret the new insights nor the expertise to turn them into a competitive advantage. For some companies, focusing on small data often makes more sense.

It’s not hard to see why the temptation to jump headfirst into a big-data project can be strong. Giants like Amazon, Google, and Walmart showcase how an entire enterprise can be built around the interpretation of unfathomable masses of data. These companies have perfected the science of gleaning — and capitalizing on — detailed insights about customer behavior. (For example, Walmart was able to pinpoint something as specific as what kind of Pop-Tarts customers stock up on before a storm — strawberry.) With similar analytics tools now available to companies in all kinds of industries, the opportunity to turn hype into hope may be irresistible.

Companies within the logistics and supply chain industries don’t seem to be impervious to the draw of big data. In fact, a survey conducted by Supply Chain Insights found that one fourth of respondents had a big data initiative in place and 65% planned on launching one in the near future. A full seventy-six percent of survey respondents viewed big data as an opportunity. The promise of benefit from the theoretical application of big data no doubt sharpens its appeal. A supply chain company could on the demand side, for example, determine to use big data to map all the quotes and online searches that never became orders and change its marketing strategy based on a newfound understanding of how the purchase of one product leads to the purchase of another. On the supply side, big data could be used to measure the impact of a catastrophic event on suppliers abroad, and consequently, allow the company to plan in advance to mitigate the effects on American consumers. These big data benefit examples could lead to significant advantage for companies with the expertise, structure, and knowledge to collect, analyze, and draw strategy cues from large sets of raw data. Unfortunately, small and mid-sized companies usually aren’t well positioned to do so.

Start Small

Starting with small data, even if you want to eventually head into big data, is a solid strategy that will produce lasting results. To start, clearly articulate what kinds of data you want to collect and begin running a few simple analytics. Choose from which sources you’ll draw data, because randomly scanning everything between heaven and earth will do you no good. Align your goals with your business objectives and turn your analytics professionals loose on the data. If your company doesn’t have in-house analytics expertise, work to attract the appropriate talent; regardless of whether or not you have a new hire, integration and structuring of analytic personnel positions will be a more significant factor in your success than even your use of the most advanced statistical software program. Finally, spend some time determining how the findings should be presented. You’ll want them to be formatted in an understandable manner and to have a clear application for how they will improve your business.

For those of you working in small to midsized companies, what’s your take on big data? What kind of approach would make a successful small-data initiative?

by Fronetics | Mar 19, 2015 | Big Data, Blog, Data/Analytics

“[Companies] don’t know how to manage it, analyze it in ways that enhance their understanding, and then make changes in response to new insights… they don’t magically develop those competencies just because they’ve invested in high-end analytics tools.” –You May Not Need Big Data After All” Harvard Business Review, December 2013

Since the concept of big data became the buzzword du jour, big data has become big business. But a recent study by Harvard Business School suggests that many big-data investments fail to deliver because most companies can’t handle the information they already have. That’s why when it comes to big data, bigger is not always better, particularly for small to midsized companies. Lured by the promise of big payoffs, many companies have sunk millions of dollars into sophisticated data analytics software only to realize they did not have the capabilities to interpret the new insights nor the expertise to turn them into a competitive advantage. For some companies, focusing on small data often makes more sense.

It’s not hard to see why the temptation to jump headfirst into a big-data project can be strong. Giants like Amazon, Google, and Walmart showcase how an entire enterprise can be built around the interpretation of unfathomable masses of data. These companies have perfected the science of gleaning — and capitalizing on — detailed insights about customer behavior. (For example, Walmart was able to pinpoint something as specific as what kind of Pop-Tarts customers stock up on before a storm — strawberry.) With similar analytics tools now available to companies in all kinds of industries, the opportunity to turn hype into hope may be irresistible.

Companies within the logistics and supply chain industries don’t seem to be impervious to the draw of big data. In fact, a survey conducted by Supply Chain Insights found that one fourth of respondents had a big data initiative in place and 65% planned on launching one in the near future. A full seventy-six percent of survey respondents viewed big data as an opportunity. The promise of benefit from the theoretical application of big data no doubt sharpens its appeal. A supply chain company could on the demand side, for example, determine to use big data to map all the quotes and online searches that never became orders and change its marketing strategy based on a newfound understanding of how the purchase of one product leads to the purchase of another. On the supply side, big data could be used to measure the impact of a catastrophic event on suppliers abroad, and consequently, allow the company to plan in advance to mitigate the effects on American consumers. These big data benefit examples could lead to significant advantage for companies with the expertise, structure, and knowledge to collect, analyze, and draw strategy cues from large sets of raw data. Unfortunately, small and mid-sized companies usually aren’t well positioned to do so.

Start Small

Starting with small data, even if you want to eventually head into big data, is a solid strategy that will produce lasting results. To start, clearly articulate what kinds of data you want to collect and begin running a few simple analytics. Choose from which sources you’ll draw data, because randomly scanning everything between heaven and earth will do you no good. Align your goals with your business objectives and turn your analytics professionals loose on the data. If your company doesn’t have in-house analytics expertise, work to attract the appropriate talent; regardless of whether or not you have a new hire, integration and structuring of analytic personnel positions will be a more significant factor in your success than even your use of the most advanced statistical software program. Finally, spend some time determining how the findings should be presented. You’ll want them to be formatted in an understandable manner and to have a clear application for how they will improve your business.

For those of you working in small to midsized companies, what’s your take on big data? What kind of approach would make a successful small-data initiative?

by Fronetics | Mar 16, 2015 | Blog, Marketing, Social Media, Strategy

How your business can use social media to generate leads.

Leads are essential to the growth of your business, and your marketing strategy is built around finding and connecting with leads. So when 92% of all marketers indicate that their social media efforts have generated more exposure for their businesses, you should take note and make social media part of your prospecting strategy.

Building a network of online connections is an effective way to find new leads. And with social media, you can find new leads by doing something called social prospecting. Social prospecting is the art of searching the social web, identifying potential prospects for your business, and engaging them in a manner that draws them to your company’s website and through your funnel. At the core, social prospecting is about listening. It’s about listening to social media conversations in order to generate leads for your business. It goes beyond monitoring keywords to engaging people that may or may not know what your business can do for them.

As you build your social prospecting strategy and develop new approaches to connect with leads, keep these 25 handy tips close by to guide your efforts.

Twitter

- Post content that draws prospects back to your website.

- Aim to share useful content on Twitter two to three times per week.

- Make customers feel appreciated by prioritizing their questions.

- Keep prospects engaged by retweeting some of their organic content.

- Favorite tweets with content that leads share.

- Respond to and offer help to industry peers’ questions.

- Delight customers by replying or favoriting tweets when they mention your company.

- Engage with potential prospects by offering help using relevant content.

LinkedIn

- Post at least twice a week to your company’s LinkedIn page.

- Join five LinkedIn Groups that could connect you with potential prospects.

- Join conversations in the group where you can add value with your content.

- “Like” content that others are sharing in the group.

- Share your own content to the group.

- Use LinkedIn Answers to respond to questions posted by others in your industry.

- Make a habit of routinely reviewing the content posted within your groups.

- Comment and add value to posts from others in the group.

- Ask for an offline meeting with your most engaged prospects.

Facebook

- Link to your blog from Facebook.

- Add calls to action to posts.

- Promote a special product or service offer solely for Facebook fans.

- Create and post visual content, like infographics and videos.

- Share a quote or industry statistic with your fans.

- To draw more comments from fans, pose a question.

- Create a Facebook event to promote trade show appearances or webinars.

- Update your company’s profile and cover photos routinely.

Ready to build a more full-bodied social prospecting strategy? We’ve laid out the quickest ways for you to find more leads and prospects on Twitter, Facebook, LinkedIn, Pinterest, and Google+ in our social prospecting workbook. In a dedicated worksheet to each of those social media platforms, you’ll find every worksheet includes: a short preparatory work to make the actual prospecting easy; visual instructions on how and where to find prospects; pro tips that will help you get the best results; prescriptions (Marketing Rx) for success; and take-home exercises for follow-up prospecting. To get started growing your prospecting opportunities and building alternative lead generation and nurturing strategies, download our free workbook.

Curious about what we’re up to on social media? Find out.

by Fronetics | Mar 16, 2015 | Blog, Marketing, Social Media, Strategy

How your business can use social media to generate leads.

Leads are essential to the growth of your business, and your marketing strategy is built around finding and connecting with leads. So when 92% of all marketers indicate that their social media efforts have generated more exposure for their businesses, you should take note and make social media part of your prospecting strategy.

Building a network of online connections is an effective way to find new leads. And with social media, you can find new leads by doing something called social prospecting. Social prospecting is the art of searching the social web, identifying potential prospects for your business, and engaging them in a manner that draws them to your company’s website and through your funnel. At the core, social prospecting is about listening. It’s about listening to social media conversations in order to generate leads for your business. It goes beyond monitoring keywords to engaging people that may or may not know what your business can do for them.

As you build your social prospecting strategy and develop new approaches to connect with leads, keep these 25 handy tips close by to guide your efforts.

Twitter

- Post content that draws prospects back to your website.

- Aim to share useful content on Twitter two to three times per week.

- Make customers feel appreciated by prioritizing their questions.

- Keep prospects engaged by retweeting some of their organic content.

- Favorite tweets with content that leads share.

- Respond to and offer help to industry peers’ questions.

- Delight customers by replying or favoriting tweets when they mention your company.

- Engage with potential prospects by offering help using relevant content.

LinkedIn

- Post at least twice a week to your company’s LinkedIn page.

- Join five LinkedIn Groups that could connect you with potential prospects.

- Join conversations in the group where you can add value with your content.

- “Like” content that others are sharing in the group.

- Share your own content to the group.

- Use LinkedIn Answers to respond to questions posted by others in your industry.

- Make a habit of routinely reviewing the content posted within your groups.

- Comment and add value to posts from others in the group.

- Ask for an offline meeting with your most engaged prospects.

Facebook

- Link to your blog from Facebook.

- Add calls to action to posts.

- Promote a special product or service offer solely for Facebook fans.

- Create and post visual content, like infographics and videos.

- Share a quote or industry statistic with your fans.

- To draw more comments from fans, pose a question.

- Create a Facebook event to promote trade show appearances or webinars.

- Update your company’s profile and cover photos routinely.

Ready to build a more full-bodied social prospecting strategy? We’ve laid out the quickest ways for you to find more leads and prospects on Twitter, Facebook, LinkedIn, Pinterest, and Google+ in our social prospecting workbook. In a dedicated worksheet to each of those social media platforms, you’ll find every worksheet includes: a short preparatory work to make the actual prospecting easy; visual instructions on how and where to find prospects; pro tips that will help you get the best results; prescriptions (Marketing Rx) for success; and take-home exercises for follow-up prospecting. To get started growing your prospecting opportunities and building alternative lead generation and nurturing strategies, download our free workbook.

Curious about what we’re up to on social media? Find out.