by Fronetics | Jun 25, 2015 | Big Data, Blog, Data/Analytics, Internet of Things, Marketing

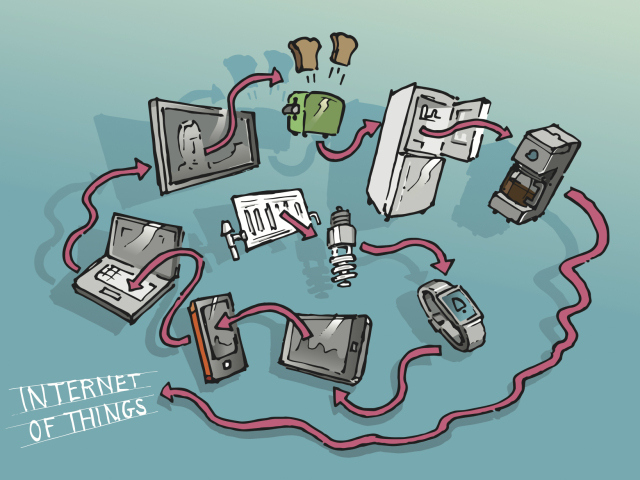

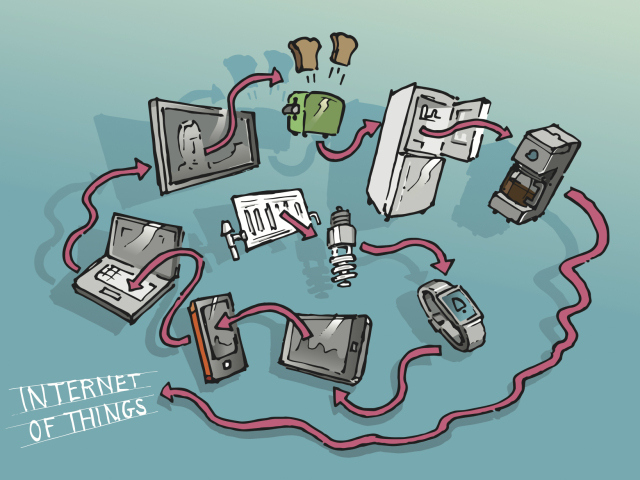

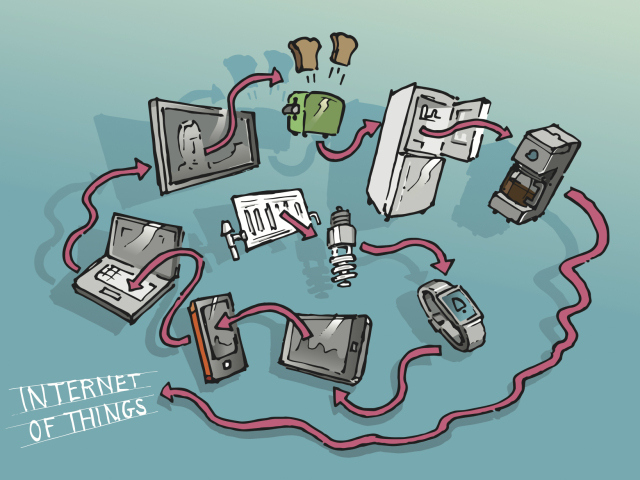

From coffee makers to urban design, the Internet of Things (IoT) is affecting change in virtually all aspects of daily life. And even though the IoT is still at the early-adopter stage, in just five years 50 billion devices are projected to be connected to the Internet, generating an estimated $2 trillion to $14 trillion in value. Expectations are running high, so high, in fact, that Gartner ranked IoT at the top of its 2014 Hype Cycle for Emerging Technologies.

Companies are naturally eager to get a piece of the action with as many as three out of four exploring how IoT technologies could fit into their business operations. Too many times, however, companies end up with mountains of data and no actionable information. Entry into the IoT should come with warnings: analyze the data or prepare to be disappointed. Or, data without analytics is nothing but noise.

But unless businesses turn the focus away from pure data collection to data analysis, investments in IoT technologies are doomed to produce disappointing results. To be truly useful, the data should do more than “look pretty on a dashboard,” as Steven Sarracino, founder of Activant Capital Group, LLC, in Greenwich, Conn., pointed out.

Vendors of sensor technologies would simultaneously be wise to take their services beyond singing the virtues of amassing data to showing their clients how to make sensor-driven decisions. In fact, the need for more guidance was underscored in a fleet report by Tracking Automotive Technology: TU Automotive (previously Telematics Update). Vendors should, according to the report, present the data in a digestible format to assist overwhelmed end-users. While purely monitoring the performance of a forklift, for example, provides value, it is not until the data is analyzed and acted upon that maximum ROI is achieved. In the case of a forklift fleet, it might entail optimizing routes in the warehouse or performing preventive maintenance. As another example, the retail sector can apply analytics to data collected by security cameras and Wi-Fi beacons to help retailers understand what types of displays catch customers’ attention.

The adoption of IoT technologies will likely come easier to industries such as manufacturing and supply chain which already connect machinery and fleets with Internet-enabled sensors or devices. Smart grid technologies also hold a lot of promise for public utilities based on current industry trends, connecting countless data points for continuous monitoring and proactive management of the power supply. However, until companies are able to adequately apply analytics to squeeze value out of their investments, it may be a while before IoT technologies reach critical mass.

by Fronetics | Jun 24, 2015 | Blog, Content Marketing, Marketing, Social Media

Marketing that drives success and elevates brand position.

Fronetics Strategic Advisors is a management consulting firm. Since the company was founded we have worked with companies to identify and execute strategies for growth and value creation. We have advised and worked with companies on their most critical issues and opportunities: strategy, organization, talent acquisition, performance management, and M&A support.

In addition to the more traditional consulting services we offer, we have working with companies to create and execute marketing strategies that drive success and elevate their brand position within the industry. Unlike other firms, we are able to draw upon our business expertise and align marketing programs with business objectives and, through a data driven approach, are able to deliver results with a targeted ROI.

We work with clients to develop and implement effective digital and content marketing strategies and to create content including blog posts, articles, case studies, eBooks, and white papers. We also offer social media management.

The following are results realized by three of our clients:

Client A

Industry: Consulting

Timeframe: 21 months

Results:

Over the period of 21 months, Client A gained 6 customers and increased revenue by 93%

Traffic to the website increased by 11,045%. Traffic from all sources increased significantly; direct traffic and traffic driven by social media realized the greatest increase.

| Source |

% change |

| Social Media |

82,900% |

| Direct Traffic |

67,800% |

| Organic Search |

9,380% |

| Email Marketing |

5,900% |

| Referrals |

1,030% |

| Total |

11,045% |

Client B

Industry: Real estate

Timeframe: 3 months

Results:

Over the period of 3 months, Client B. realized an 88% increase in inquiries and a 39% increase in home sales.

Traffic to the website increased by 248%. Traffic from social media and from referrals realized the greatest increases.

| Source |

% change |

| Social Media |

894% |

| Direct Traffic |

159% |

| Organic Search |

157% |

| Referrals |

360% |

| Total |

248% |

Client C

Industry: Foodservice

Timeframe: 11 months

Results:

The client has realized a visit to lead conversation rate equal to 50% above the industry average.

The client, per industry standards, realized a savings of 13% per lead.

Traffic to the website increased by 119%. Traffic generated by organic search and social media were the primary drivers of increased traffic.

| Source |

% change |

| Organic Search |

231% |

| Social Media |

166% |

| Direct Traffic |

53% |

| Referrals |

22% |

| Total |

119% |

by Fronetics | Jun 23, 2015 | Blog, Logistics, Marketing, Social Media, Strategy, Supply Chain, Transportation & Trucking

Drew McElroy, founder of the start-up Transfix, is no newcomer to the trucking industry. McElroy was born into the business; his parents owned and operated the freight brokerage Andrew’s Express, affectionately naming it after McElroy.

“I remember listening to my father structure deals. As a kid, it was all utterly confusing to me,” recalls McElroy. “I finally started to get my head around the economics of the business in my teens. From that point on, I became increasingly aware of the industry’s inefficiencies.”

Not long after McElroy graduated college, his father passed away unexpectedly. McElroy, already working for the family business, took over as president. In that time, McElroy successfully increased annual revenues from $4 million to $12 million. While impressive, McElroy still struggled with how the industry traditionally operated. “It was clear that our family business wouldn’t be the platform for world domination,” laughs McElroy. “But I believed that, fundamentally, there was a better way to get things done.”

Determined to build a new foundation based on his belief in “a better way,” McElroy left the family business and set out for San Francisco. He would spend the next year and a half couch surfing and networking in order to gain the expert business and tech insight he needed to plan what would become Transfix. “I knew logistics and I knew trucking, but I knew nothing about venture capital, or how to move from idea to implementation,” says McElroy. “I decided I should try – and try big. If I fail, I fail, but at least I tried.”

In 2013, McElroy was introduced to Jonathan Salama. Salama was among Gilt’s early engineers, and was pivotal in building the flash sale giant’s infrastructure and inventory software. McElroy knew Salama would be key in taking his idea to the next level; Transfix had claimed its co-founders, and its recipe for industry-leading success.

Transfix is a fully automated marketplace that is all about getting things from one place to another. What sets Transfix apart is the company’s platform and approach is vastly more efficient than the traditional approach, and it is much more user-friendly.

Transfix takes the industry’s inefficiencies head on. Transfix is a digital on-demand freight marketplace. It provides industry-leading mobile technologies and location-based jobs offers for independent over-the-road truck drivers, as well as cloud-based management platforms for small carriers and shippers

Here’s how it works:

A customer logs into the Transfix TMS and enters a new shipment. The platform automatically identifies the best driver depending on location, size of truck, etc., sending a load offer alert to the driver or company dispatcher by mobile SMS message or email. The load is accepted by electronic signature, at which point the customer receives automatic notification and the driver becomes fully visible within the customer’s real-time dashboard. Load management from that point on becomes “as simple as Tinder.” Transfix geofences the driver with a five mile radius, immediately alerting Transfix of any issues. Once the load is delivered, the driver is paid within 24 to 48 hours, significantly faster than the industry standard.

Transfix just launched an app (iOS and Android) that is focused on truck drivers. Transfix’s app integrates with the company’s digital marketplace and is driver-centric. The app gives drivers the ability to manage loads, map their itinerary, and manage payments. The app also provides truck drivers with trip planning essentials including the location of showers, ATMs, weigh stations, fuel prices, and weather. The app is free and can be used by anyone with a valid motor carrier number – the driver does not have to associated with Transfix. “Developing this app and making it freely available to all drivers is just the right thing to do,” says McElroy. “Without drivers, this industry would not exist. We need to do right by drivers by making their lives easier.”

Things are moving fast for McElroy and Transfix. Within 15 minutes of updating his LinkedIn profile, McElroy got a call from a logistics Manager at Barnes & Noble and, before he hung up, had freight loads to manage. Fast forward a few months – with Transfix, Barnes & Noble has realized improvements in their processes and has seen their deadhead runs (times driving without cargo) cut by at least 50%.

Transfix has raised close to $2.5 million to date and is already generating several thousand a month in revenue.

McElroy and Transfix are poised for world domination – mind you, a win-win benevolent hegemony – a la Uber.

Fronetics Strategic Advisors is a leading management consulting firm. Our firm works with companies to identify and execute strategies for growth and value creation.

Whether it is a wholesale food distributor seeking guidance on how to define and execute corporate strategy; a telematics firm needing high quality content on a consistent basis; a real estate firm looking for a marketing partner; or a supply chain firm in need of interim management, our clients rely on Fronetics to help them navigate through critical junctures, meet their toughest challenges, and take advantage of opportunities. We deliver high-impact results.

We advise and work with companies on their most critical issues and opportunities: strategy, marketing, organization, talent acquisition, performance management, and M&A support.

We have deep expertise and a proven track record in a broad range of industries including: supply chain, real estate, software, and logistics.

by Jennifer Hart Yim | Jun 22, 2015 | Blog, Manufacturing & Distribution, Strategy, Supply Chain

This article is part of a series of articles written by MBA students and graduates from the University of New Hampshire Peter T. Paul College of Business and Economics.

Melanie Payeur graduated from the University of New Hampshire in 2007 with a degree in Mechanical Engineering. She has since worked in various roles supporting manufacturing and packaging operations in the food and beverage industry.

Do you know where your byproducts go?

Do you know where your byproducts go?

Manufacturing often produces some sort of physical byproduct. Examples range from plastic strapping on a pallet of corrugate boxes to carbon dioxide collected off a tank of fermenting beer. Byproducts are the unspoken of and often neglected “cousin” of manufacturing.

Byproducts of manufacturing can be compared to the stage crew at a Broadway show or on a Hollywood movie set. They serve an important purpose. Without the lights, cameras, and curtains, there is no show. Similarly, without plastic strapping, a pallet of corrugate would fall over during transport because it wasn’t properly secured.

The stars of the show are the finished goods on store shelves. Just like people don’t stick around to see the name of the on-set hair-stylist when the credits roll at a movie, consumers often don’t think about the byproducts associated with the packaged food they eat or other goods they purchase. It’s possible that they don’t even know these things exist.

However, consumers are becoming more conscious of supply chain issues. Many have an awareness what Fair Trade is in association with sourcing of products such as coffee and cocoa beans. They discuss agricultural sourcing and the ethical (or not) treatment of animals raised to be part of the food chain. Even the effects of emissions and chemical waste on the environment are among topics of which many consumers have some awareness.

Plastic old, Plastic new

What about the plastic strapping on that pallet of corrugate though? Where does it go? Who even knows it exists other than the operator that cuts it off the pallet in the factory? Could it become a plastic bottle someday? Or a swing set? Maybe it will become plastic strapping again?

While countless other types of byproducts exist, plastic is a particularly interesting example. Fluctuations in the price of petroleum are directly correlated to the price of brand new, non- recycled plastic pellets. It is completely possible, and often realistic, that it is less expensive to create brand new plastic strapping than it is to recycle old strapping.

Trailer Bags and Trash Bowls

Creative and novel uses of byproducts are happening today. One example is a Swiss company called Freitag who produces trendy messenger bags, wallets, and purses from old side panel tarps (popular on tractor trailers in Europe). At the end of their useful life on the road, these tarps are purchased by Freitag and sewn into functional accessories.

Another example specifically related to plastic are Garbage Bowls made famous by Food Network host, Rachael Ray. These bowls are made from recycled pieces of broken plates. There’s a byproduct in there somewhere!

While these are great examples of repurposing byproducts into something new, the truth is that Freitag was originally looking for a material that would create a durable and functional product. Lucky for them, reusing something that might have otherwise been thrown away is a great marketing story. They charge an average of $200 for a standard messenger bag. Is it realistic that the reverse situation can create profits? Can we find another use for production process byproducts which would create a trendy or otherwise highly desirable product?

Can we do better than throwing our byproducts away?

If it’s not a company’s core competency, it probably shouldn’t get into the business of designing handbags. However, as supply chain professionals, we should understand all of the byproducts of our manufacturing process; especially those related to materials that we source as inputs, like plastic strapping.

It is as important to look at the waste stream from our process as it is to examine how we source raw materials. Are we recycling our byproducts? Is there someone who is looking for our ‘trash’ as an input to their process? Do we have the opportunity to have a profitable side business as a coincidental supplier to someone else? At the very least, can we do better than throwing our byproducts away?

An example of success can be seen in the food manufacturing industry. Some companies donate or sell their byproducts to the Bakery Feeds Program. This organization creates animal feed out of food byproducts such as misshapen cupcakes and other edible process waste. It might be cost neutral to dispose of waste in this way, but that is better than otherwise paying for disposal.

I challenge you to examine the waste streams associated with your process. Identify where at least one of your byproducts could go. From here to there and there to here, your byproducts could end up anywhere.

by Jennifer Hart Yim | Jun 18, 2015 | Blog, Logistics, Manufacturing & Distribution, Strategy, Supply Chain

This article is part of a series of articles written by MBA students and graduates from the University of New Hampshire Peter T. Paul College of Business and Economics.

Ben Minerd received his B.S. in Computer Engineering from the University of New Hampshire in 2011 and will be completing his MBA from UNH in May 2015. When not working as a systems engineer, Ben enjoys skiing, hiking, and flying drones.

Some of you technologically curious readers may be familiar with Moore’s Law which predicted that the number of transistors in a dense integrated circuit would double every two years. What all that nerd speak (as a nerd I can use that phrase) boils down to is that the processing capability of electronic chips is increasing at a crazy rate. Like, scary fast.

On the flip side, electronics are really cheap these days. Yes, the $10,000 Apple Watch might be a tad pricey, but I’m talking about the industry as a whole. You can buy a computer that fits in your pocket for $200 that is many hundreds, maybe thousands, of times more powerful than my first computer and I’m one of those whiny millennial youngsters.

How can consumer electronics companies afford to sell their scary fast devices this cheaply? One reason is that the devices are being made by other devices (cue ominous music), as automation and electronics manufacturing are natural complements of each other. But another big factor in the cheap tech equation is the ever-increasing separation of technology development from technology manufacturing.

Contract Manufacturing

Big name companies like Apple, Google, Microsoft, and Amazon are doing less and less of their own widget building these days in favor of contract manufacturing (or CM). Contract manufacturing is essentially the outsourcing of your products’ fabrication and assembly to some other company (who is hopefully better at it than you are).

In theory, using a contract manufacturer should lower your costs and give you access to capabilities that you wouldn’t have access to otherwise. This is especially true of small businesses looking to produce physical goods (versus intangibles like software), where the up-front cost of building your own factory is immense and maybe even a non-starter. Or maybe you’re a big tech company who isn’t good at making hardware (ahem, Google) and you want to stick to your core competencies.

Whatever your reason, contract manufacturing is the unicorn that will slash your costs with its rainbow laser beam eyes. Well, maybe not entirely.

Hidden Costs

To loosely paraphrase Pee-wee Herman, every decision we make in business has a big ‘but’. For the economist reader, you can equate this with TANSTAAFL—There Ain’t No Such Thing As A Free Lunch. One action almost always leads to some other potentially unexpected outcome. Certain people have even gone so far as to say this is always the case (some guy named Isaac Newton).

One of the biggest contributors to hidden costs within contract manufacturing is the loss of control over your production processes. While this might be obvious or even desired, there may be some complications as a result of this new relationship that you hadn’t thought of previously.

Communication is always an important topic, but even more so when it comes to contract manufacturing. Not only may your production team physically reside on the other side of the globe, but things like language, culture, and time zone differences can make it difficult to keep good lines of communication open.

Quickly ramping up or ramping down production to meet changing demand can become a lot more challenging, too. This is partly due to the nature of the shared resources that you are buying access to when you team up with a CM.

A classic example of a culmination of these issues came from Cicso in the early 2000’s, back when out-sourcing was in its infancy. Cisco had been riding the surging wave of growth in the telecommunications industry which starting leading to supplier shortages. Shortly thereafter, the bottom fell out of telecom and Cisco forgot to turn off the contract manufacturing tap. Before long, Cisco’s raw-parts inventory rose by more than 300% from Q3 to Q4 2000, leading to a $2.2 billion write-off of inventory. Wall Street responded as you might expect, causing Cisco’s stock to fall by 50%.

The Human Cost

Perhaps the greatest hidden cost is one that may never make it to your company’s balance sheet: exploitation of workers in the developing countries where many contract manufacturers do business. It’s no secret that the biggest driver behind outsourcing is low labor costs. While it’s not always apples-to-apples to compare a production worker’s wage in China to one in the U.S., by any measurement the difference is more than a factor of 10 (although that number is dropping).

This dirty little secret of the consumer electronics industry came to light in 2012 when it was discovered that Foxconn, the largest electronics CM with over $100 billion in revenue and manufacturer of the Apple iPad, was mistreating some of their workers. Conditions grew so bad that in some cases workers decided to jump to their death rather than survive in that environment.

Bottom Line

Contract manufacturing might very well still be the right choice for you, just keep in mind that you may have more “unknown unknowns” than you had, well, known about. The more you can discuss with your CM candidate up front, the better your relationship will likely be. Also, some of these “gotcha’s” can be planned for in the agreement between you and your CM, so don’t skimp on the up-front work. And remember, there is no unicorn with rainbow laser beam eyes. That I know of.

by Fronetics | Jun 17, 2015 | Blog, Internet of Things, Strategy, Supply Chain

Software Advice, a Gartner Company, provides detailed reviews and research on thousands of software applications. The company works with buyers to identify supply chain systems that will meet their needs; therefore, making the buying process a little less murky and arduous.

Software Advice recently released the report: Supply Chain Management Software, BuyerView. The report is based on findings from discussions with supply chain management (SCM) professionals across industry verticals who are seeking to deploy new software solutions.

We talked with Forrest Burnson, Market Research Associate at Software Advice, about the report and its findings:

What were the biggest take aways from the research?

Businesses both large and small are investing heavily into supply chain management software. They’re realizing the power of big data within their organizations and they’re looking for specialized software solutions to help increase visibility into their supply chain. All too often many of these businesses are being hindered by outdated systems and processes.

Where there any surprises? If so, what were they.

Nothing too surprising, though I was definitely a little surprised by the budget estimates the prospective buyers were providing. It makes sense though: Prospective buyers of SCM software tend to be quite savvy, so sticker shock doesn’t affect them as much—they know have an idea of what they’re looking for and they’re willing to fork the money over because they realize the benefits this software can have on their organization.

Do your findings point to any trends (current or future) within the industry?

Software is becoming increasingly important in supply chain management, and more and more smaller businesses are catching on to that trend. Even five years ago there weren’t as many solutions available for SMBs that there are now.

Only 6% of small businesses use commercial SCM software. Why is this?

Many of the smaller businesses got by without commercial SCM software for years, but it’s just not possible for them to continue with their old methods. This also presents a huge opportunity for SCM software vendors, as the SMB market has been historically underserved.

How does it compare to the percentage of larger businesses?

Twenty-one percent of large businesses we spoke with were currently using SCM software.

Small businesses are budgeting more for SCM software. Why is this?

A couple reasons—there are more solutions available to them at a lower price point, and economic pressures are forcing many SMBs to adapt and evolve. That they’re budgeting more tells us that they recognize not only the cost but the return on investment it can potentially have.

Are large businesses also budgeting more?

Yes, we found they are budgeting approximately $171,000 for new SCM software.

To learn more, access the entire report.