by Fronetics | Oct 1, 2015 | Blog, Content Marketing, Marketing, Strategy

Around the time when the leaves start changing color every year, companies turn their focus to year-end revenue and gross profit forecasts. Those forecasts, in turn, are used to inform the establishment of sales and revenue targets for the following year. These goals can inspire your sales team to re-imagine internal processes to drive stellar results. Or, they can have a real demotivating effect on the team and organization.

Follow these four steps to create challenging but achievable goals that will lead you to better results, more consistent targeting, and a team that is motivated for the long run.

Evaluate

Look at the current state of your business and define your desired sales/revenue outcome based on this knowledge. Yes, this is much harder than saying, “my boss says to grow by 30%”, but the deep understanding of you current state will lead your organization stop focusing on the numbers to achieve and start focusing on the process of achievement. This is the hardest and most detailed step.

Segment

Once you have established the current state and desired outcome; break up these revenue/sales numbers and the process to get them into small portions. By doing this, you establish a pattern of smaller wins/process goal attainment. In the end, you will have developed a culture of winning and/or adjustment instead of an “all or nothing” mentality.

Structure

Now, build in a system that rewards superior behavior and discourages falling short. You will still have the over-achievers….they need to feel fairly treated for being better than average. You will have folks who fall short…they need redirection and course correction (maybe even managed out of the business). Remembering that since these are “small chunks” your team never gets too far behind before a correction can occur and your top performers are still treated as stars.

Adjust

Lastly, develop a culture of “adjustment”, both up and down. Most teams are used to a big target at the beginning of the year that never adjusts….you win or you lose….and so does your company. I think we all know the reality is that in the current economic environment, it’s not that simple. Having the ability to adjust as your “knowledge of the current state” becomes definite allows you to throttle up when you can and down when you have to.

One word of caution, if you try this approach you need to commit all the way. A half attempt at this would be disastrous. You need to commit to change in order to change your culture and to get the results that you want. One last thing, if you are now saying to yourself, “that’s all well and good, but my external stakeholders (lenders, principles, shareholders, managers, etc.) aren’t sympathetic to this type of curved lined forecasting”. I get that too. The answer is simple. Once have your current state defined and your desired outcomes articulated, take a conservative approach to this forecast and decide whether it is good enough for your external stakeholders. If it is, you have your worst case scenario that should only be affected by upside surprises. If it’s not, no hoping or praying for you to achieve your goals is going to make it any prettier in the long run. Make the strategic adjustments now and be better off at the end of the year.

by Elizabeth Hines | Sep 29, 2015 | Blog, Strategy, Supply Chain

Across the globe, many industries are seeing aftermarket services outperforming the general market. We can point to many reasons for this occurrence: the tendency for aftermarket services to remain stable in trying times, buyers remaining flush with cash, competition among buyers driving valuations higher with historically low pricing, and buyers making strategic purchases to focus on supplementing growth of their own businesses by acquisition. Regardless of the reason why, investors have become increasingly interested in the aftermarket sector and the implications of this are significant. These deals have the power to change the market, alter customer base, and challenge companies’ competitive positions.

This is a far different story from just four years ago when an article ran in the New York Times Dealbook section by Stephen Davidoff titled, “For Private Equity, Fewer Deals in Leaner Times.” Davidoff’s article listed the primary forces that drove turbulence in that marketplace. At that time, there were too few “good” merger and acquisition opportunities, “deals” were greatly overpriced, and there were fewer sellers in the market (and the ones that were making themselves available are being snatched up by strategic buyers). But what was most interesting, and what I’ve been tracking since then, was that the private equity industry’s biggest problem was having too much money to invest. You read that correctly — too much money to invest.

When I read the phrase “too much money to invest,” it got me thinking about the hi-tech aftermarket services industry and how underserved it had been from a private equity standpoint. In the hi-tech aftermarket industry in particular, there were, and still are, plenty of really good platform companies with strong footholds in service or geographic niches that truly make them unique and valuable. What they typically lack, though, are the funds and guidance that a responsible and possibly patient private equity firm can offer. Not only do these platform companies in the high-tech aftermarket services space make for attractive investments, but it seems to me that the financials in these “niche companies” are there to support private equity interest, as well. These businesses typically have gross margins in the 35-40 percent range and net margins that are really attractive when compared with the overall hi-tech space. Combining or rolling up companies with expertise in adjacent service and/or geographic areas into a “newco” with broader reach and a deeper service offering will surely deliver financial results that private equity would consider better than not investing. The high-tech aftermarket services space is a fractionalized marketplace with accomplished participants, quality customers, and better than traditional financials when compared with the overall industry averages. And private equity firms have started to realize these points. To this, I say bravo, but there’s still lots of money that needs to be put to work.

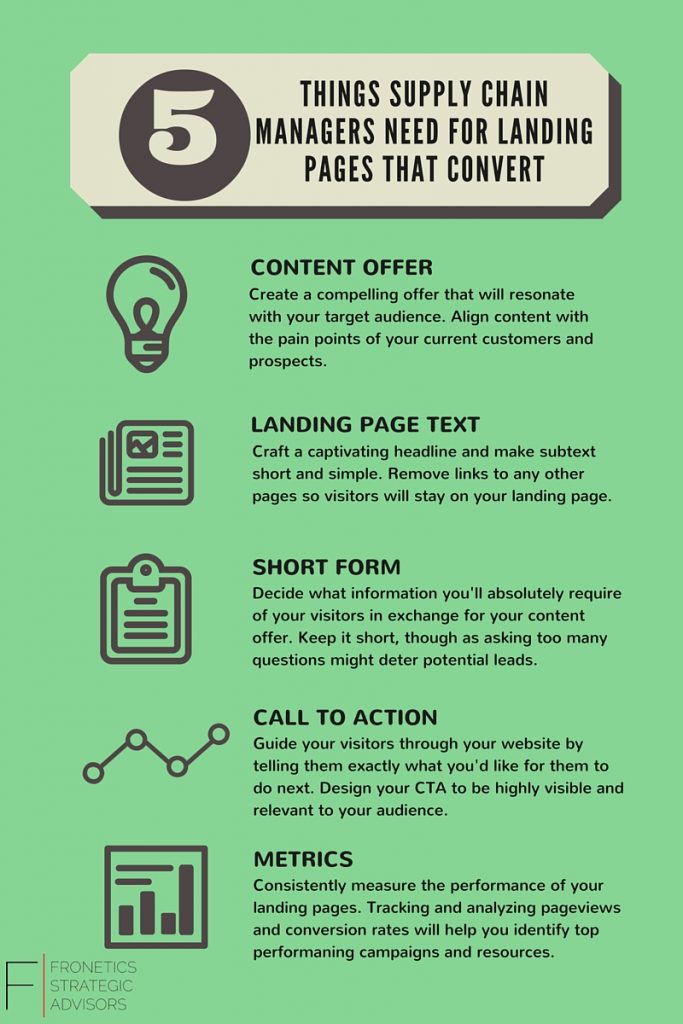

![5 Tips Supply Chain Managers Need to Build Landing Pages That Convert [Infographic]](https://www.fronetics.com/wp-content/uploads/2024/10/landing-pages-that-convert.jpg)

by Fronetics | Sep 28, 2015 | Blog, Logistics, Marketing, Supply Chain, Talent

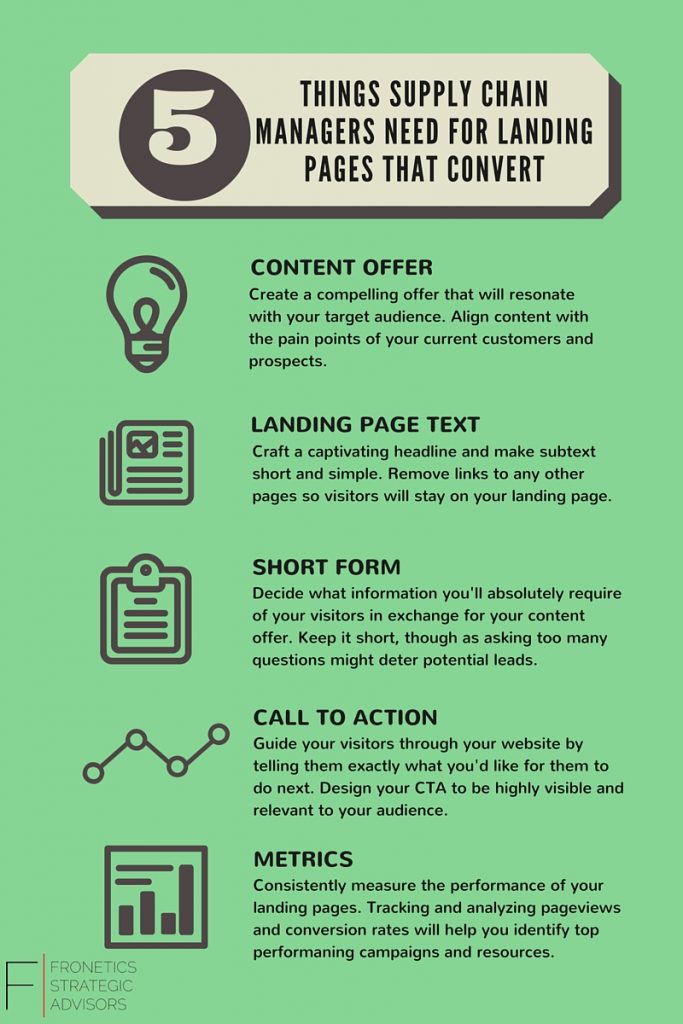

Landing pages are a fundamental tool in converting website visitors into leads. They’re what convince your visitors that they absolutely must download your fabulous resource offer. Yet often times they’re treated as the annoying little sibling to high-value content pieces – tagging along almost as if an after-thought. In reality, landing pages have just as much, and possibly even more importance than the content offer. Besides, what good is your best resource if it’s landing page stinks?

Here are five tips supply chain managers need to build landing pages that are sure to convert visitors into leads.

by Fronetics | Sep 17, 2015 | Blog, Internet of Things, Marketing, Social Media

As of January 2015 nearly half (3.01 billion) of the world’s population (7.21 billion) were active internet users. Population growth from the previous year was up 1.6%, active internet users were up 21%, and social media users were up 12%. These are big leaps, and continued growth is predicted. These numbers are a good thing, not only for people like Mark Zuckerberg, but also for business.

Here are 8 reasons why your business needs to harness the power of the internet:

by Fronetics | Sep 15, 2015 | Blog, Data Security, Data/Analytics, Marketing, Social Media, Strategy

Personal connected devices – our laptops, cell phones, and tablets – are arguably the most complicit tools in the recent blurring of the parameters between personal and work life. And while most businesses have generally recognized the benefit of allowing employees to use their personal devices for work purposes, the bring-your-own-device (BYOD) revolution has certainly thrown a curve ball to those responsible for safeguarding company data. Although corporate finance groups are singing the praises of the trend due to its inherent reduction in costs, it’s not all rosy in the BYOD world. That’s why it’s crucial to format a corporate strategy policy that will protect your company from a potentially dangerous data-leak train wreck.

Here’s why: Employees are now widely accessing corporate data from their own computer, a tablet, even their mobile phone. With so many of us bringing more and more smart devices inside our office environments and hooking them to our corporate networks, the potential for data leakage grows exponentially. When anti-virus and digital security software company BitDefender set out to explore the connectedness of typical American workers last year, they found that over half stored work-related data on their personal devices. Shockingly, almost 40 percent of them had nothing in place to prevent unauthorized access to their device. Further, in a study conducted by the University of Glasgow, 63 percent of used smart devices purchased through second-hand stores and eBay-like marketplaces still had data on them. This data included personal information as well as sensitive business information.

The problem is there’s no chain of custody in the BYOD world. Think about it. When the corporations owned your cellphone and your PC or laptop, they controlled its issue to you, how you used it, what software you put on it, and when and how it was turned in and destroyed. A solid internal tracking of electronic assets coupled with a solid electronic asset disposal solution provider meant that, for the most part, the corporate digital assets were safe. In the BYOD world, the corporation does not own the IT equipment. Personal smart devices are being linked to corporate IT environments. This mating of personal and professional equipment and data is happening everywhere. Your corporate data is being commingled with secure and non-secure access points to the Web, cloud, etc. Not to mention the fact that those devices metaphorically walk in and out of your office every day, and you have no control.

Companies are scrambling to address this issue in a number of ways. Some have addressed the problem via software solutions at the enterprise level (think Blancco or BlackBerry enterprise), some at the device level (think solutions like Apple Find My Device, etc.), and some at the human resources and legal levels with policies and procedures that prohibit users’ use of corporate information. But the truth is, without a chain of custody model incorporated with these solutions, once the corporate data is accessed or downloaded, it’s already gone — you just don’t know it yet.

The reality is that it’s going to take some time for the corporate world to catch up with what some have called the “semi-private information revolution” like the cloud, Facebook, or social media. Secure file sharing, essential for an organization’s BYOD guidelines, is one of the best options available. Services are now available to help with cloud encryption and it’s changing the way we share and monitor files. Encrypting data is crucial and minimizes the risk of sharing sensitive data and having it tampered with. Rely on your electronic asset disposal provider to help your company develop a strategy and process that is aligned with your corporate information sharing guidelines. Right now, your corporate data is only as safe as the process that you create.

Fronetics Strategic Advisors is a leading management consulting firm. Our firm works with companies to identify and execute strategies for growth and value creation.

We advise and work with companies on their most critical issues and opportunities: strategy, marketing, organization, talent acquisition, performance management, and M&A support.

![5 Tips Supply Chain Managers Need to Build Landing Pages That Convert [Infographic]](https://www.fronetics.com/wp-content/uploads/2024/10/landing-pages-that-convert.jpg)